World Nomads is one of the best known travel insurance companies in the world. They market themselves towards independent and adventurous travellers.

They’ve offered travel insurance to independent travelers since 2002, and sell travel insurance to travelers from over 100 countries.

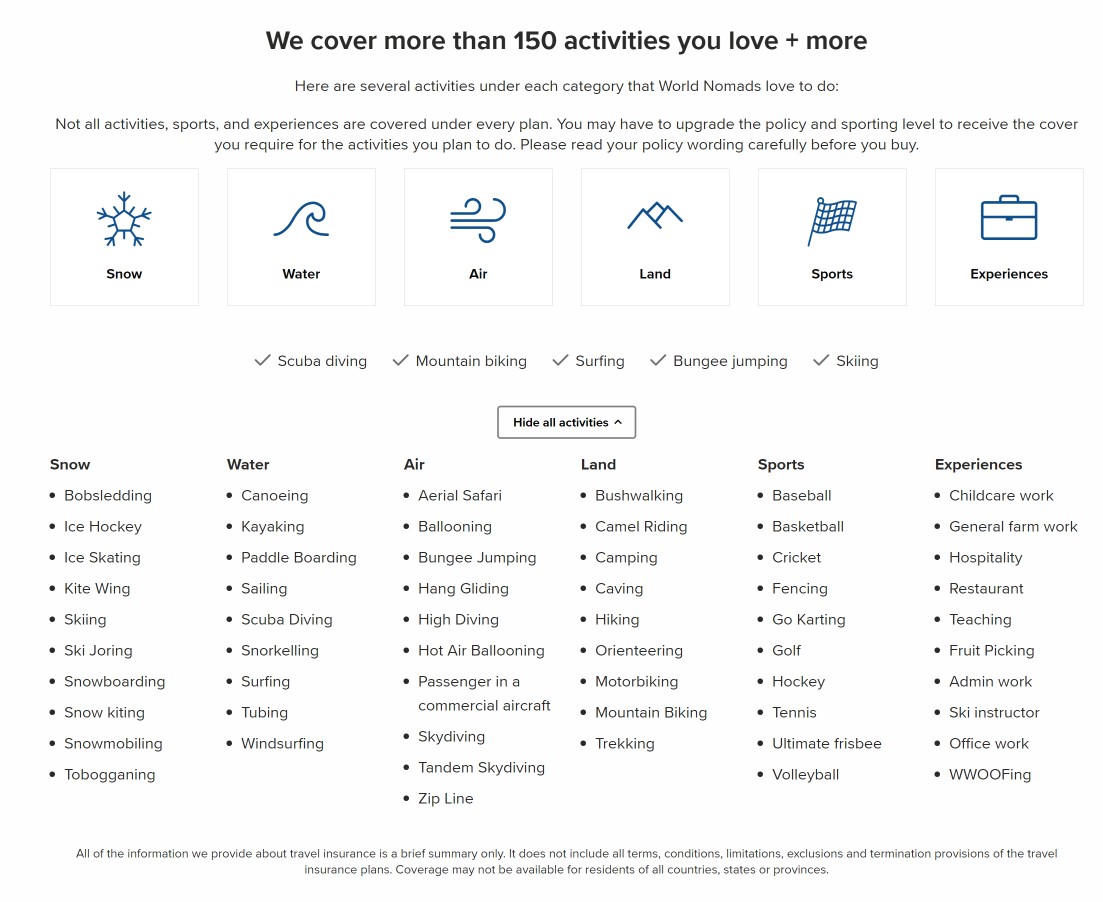

Travel insurance benefits include coverage for emergency medical and evacuation or repatriation, baggage, trip cancellation and more than 150 adventure activities. Travel insurance policies are supported by several global emergency assistance providers.

World Nomads offers simple and flexible travel insurance. Buy at home or while traveling and claim online from anywhere in the world.

World Nomads Review Bottom LineWorld Nomads travel insurance has been designed by travelers for travelers, with coverage for more than 150 activities as well as emergency medical, lost luggage, trip cancellation and more. |  |

Disadvantages

| |

Advantages

| |

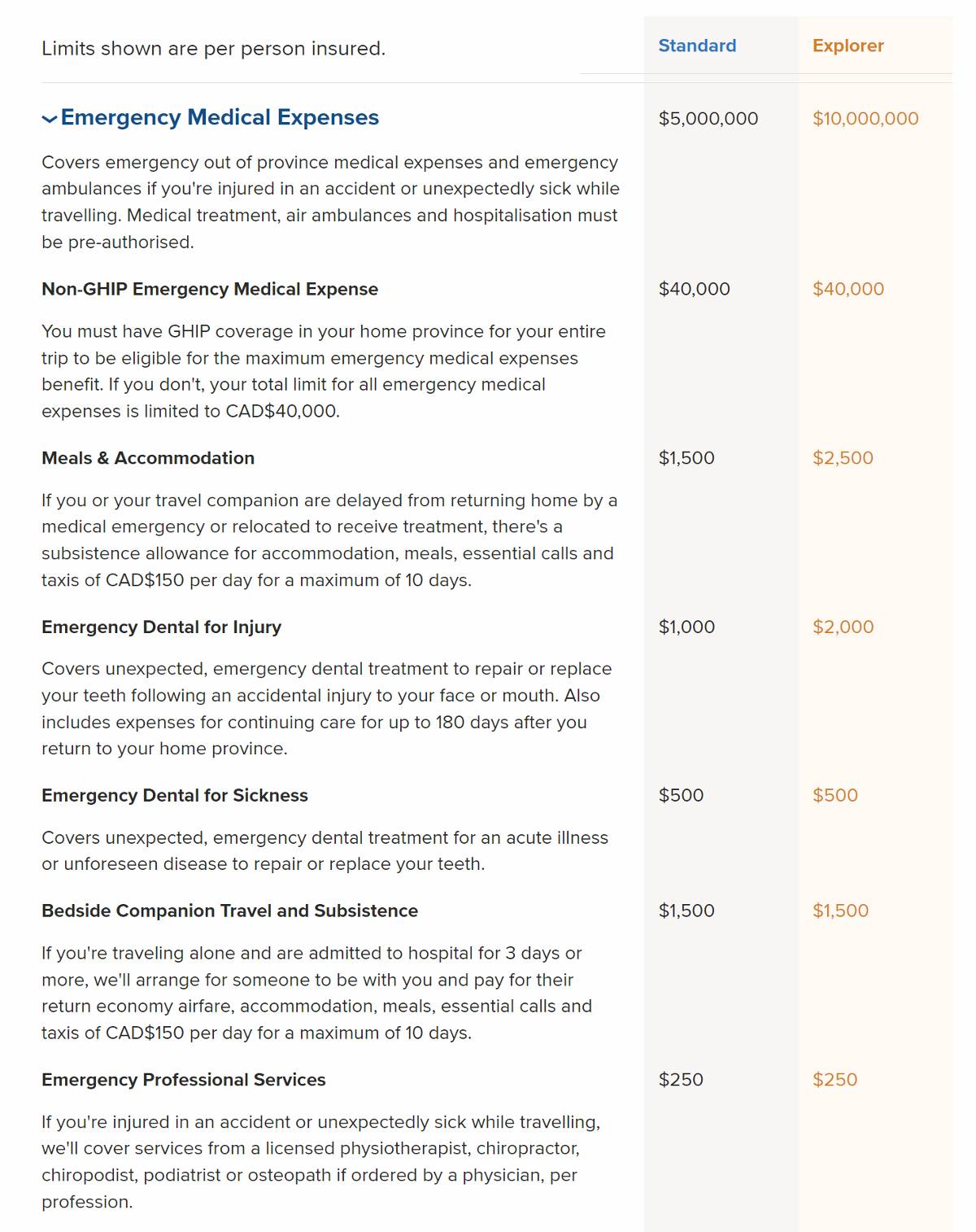

The BasicsIn the screenshot below, the coverage amounts in the left column are for the Standard Plan, while the prices in the right column are for the Explorer Plan. | |

Adventure Activities |

|

How to Learn moreWorld Nomads’ mission is to support and encourage travelers to explore their boundaries. They offer simple and flexible travel insurance and safety advice to help you travel confidently. |