RATESDOTCA lets you compare prices of more than 12 Canadian travel insurance companies online in just minutes. Formerly known as Kanetix, their price comparison site was rebranded in 2020. Rates.ca and its RATESDOTCA branding (yes they decided to shout it at you!) is a division of Kanetix Ltd., a Canadian corporation.

In 2011, according to Canadian Underwriter, the founders of Kanetix sold their ‘insurance marketplace’ platform to Monitor Clipper Partners (MCP) – a USA-based private equity firm. Then in 2018, Kanetix Ltd. was acquired by the Ontario Teachers’ Pension Plan, which refers to Kanetix Ltd. as, ‘Canada’s largest digital customer acquisition platform and marketplace’. Big money stuff.

Far from being a travel insurance specialist, RATESDOTCA is an aggregator of information where you can compare rates on a variety of financial products, including:

- Home, condo, and tenant insurance

- Car (or motor cycle) insurance

- Life, critical illness, or health and dental insurance

- Travel insurance

- Mortgages

- Credit cards

- Investments like GICs, RRSPs, TFSAs and bank accounts.

While they do provide great price comparison information, RATESDOTCA is not a licensed travel insurance agency – they aggregate the information from several companies, and then let you buy directly from the insurance company that you choose.

Advantages

- Fast and easy way to compare Canadian travel insurance quotes.

- You can get insurance directly by using RATESDOTCA online in under ten minutes.

- Rates can be the cheapest in the industry – using a wide selection of companies helps. The wider the selection, the better the pricing.

- Nice web interface makes it easy to walk through the quote process.

- You can compare travel insurance plans side-by-side, and even contact the insurance company directly if you have any questions.

- For Canadians travelling abroad, they have 13 companies to quote from (two more than BestQuote, the other travel insurance price comparison website).

Disadvantages

- You need to purchase travel insurance before you leave on your province of residence. This is standard. There are a few companies that allow Canadians to get travel insurance after leaving on a trip – but you’d need to get a broker involved.

- The RATES site doesn’t let you specify different criteria for your search, like deductible or maximum policy limit. However, it’s simple enough to use their great compare plans feature to determine which plans meet your needs.

- You must provide your email. However, this is pretty standard for providing you a link back to your quote, and you can always opt out later.

- Because they are an aggregator and not a broker (who bears some responsibility for you making a good purchase), RATES won’t provide you with agent advice about why you need to answer yes or no to a certain question on the medical questionnaire, or tell you which company has been having delays in paying their claims, etc. So if you need to answer a medical questionnaire, or have unique questions and need personalized advice or assistance – using a specialist agency like BestQuote is more advisable.

- For Visitors to Canada (who are sometimes required to buy insurance to obtain a certain visa like ‘Super Visa Insurance’), RATES has only 10 companies to quote (six less than BestQuote).

How to learn more from RATESDOTCA

How to learn more from RATESDOTCA

- Go to www.rates.ca

- Type your postal code.

- Select the options you’d like in the detail area. Leave the Trip Cost per traveller field empty if you don’t want trip cancellation insurance.

- Click the button. You may need to wait a few seconds for information to appear.

Important: If you’d like to have trip cancellation, there are two options. The first is to select the All Inclusive button at the top of the screen, but we found the insurance options to be quite expensive. A cheaper option is to select Single Trip. When your quote appears, you can click the Trip Cancellation tab at the top to see how much it would cost to add on trip cancellation insurance.

Tip: In the trip destination area, enter the country you will be visiting longest. If you’ll be spending an equal amount of time in different countries, select your final destination country.

Using RATES’ Compare Plans feature

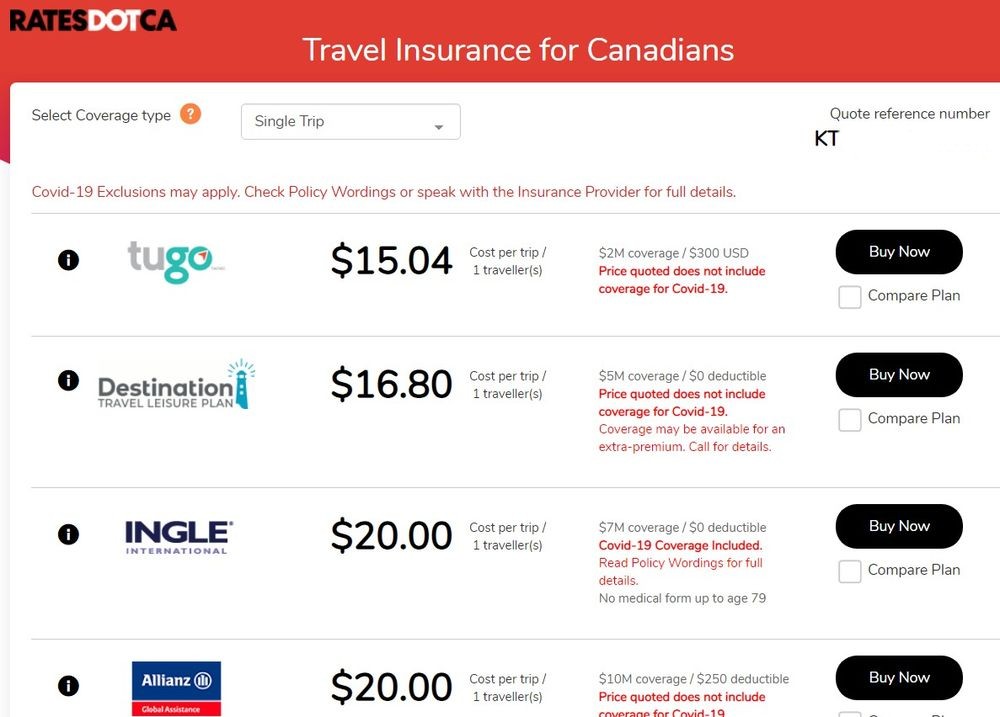

This is one of RATES’ best features. You can compare travel insurance pricing and a few key details side by side. (Of course, that’s what all price comparison sites do, thats the value they quickly add to your research).

At the bottom of your quote, click COMPARE PLANS NOW. RATES then brings up a side-by-side comparison chart. The chart is very detailed (the sample below only shows some of the information available).

Adding Trip Cancellation to your Quote

Adding Trip Cancellation to your Quote

If the plan you want doesn’t have trip cancellation, you can easily find the cost of adding trip cancellation by clicking the Trip Cancellation tab at the top of your quote.

Multi Trip (Annual) Policies May Save You Money, but…

If you travel multiple times in a year, consider getting a multi-trip quote. Multi-trip plans can be surprisingly affordable. RATES recently quoted $61.80 for single trip policy with Allianz for a two week trip to Mexico for two travellers, ages 42 and 36. A similar multi-trip policy with Allianz travel insurance was $140.00, making it a great value if you travel enough.

Make sure you read the fine print so you know the maximum time allowed per trip, and what the stability period is regarding how long any pre-existing medical conditions need to be stable (unchanged) for the policy to still cover any emergency medical expenses that can be directly tied to those underlying pre-existing conditions (for example, high blood pressure is related to cerebral and cardio vascular conditions so if that is considered to be an unstable condition, the policy won’t cover heart issues, or stroke issues. For multi-trip (Annual) policies, the stability period (i.e. 90 days, or 180 days, etc) needs to be met before each departure from your home province!

That means that, if you buy a multi-trip policy now thinking of taking three trips this year, but after the first trip you receive a change of prescription for one of your medical conditions, the multi-trip policy won’t cover that condition until AFTER the condition has returned to being defined as ‘stable’ (90, or 180 days later). Which means buying a multi-trip policy does present a bit of a gamble regarding future health changes. Keep that in mind.

You can get quotes for destinations worldwide, for durations from a day to one year. The details of the coverage depend on the specific insurance company and policy.

Even if you’re thinking about getting your insurance through a broker, do a search through rates.ca AND BestQuote to get an idea of competitive prices.

What Else Can RATES Do?

- RATESDOTCA offers a free insurance renewal reminder for any type of insurance. You don’t even need to purchase insurance from them to use this service.

- The site also offers some useful guidance and tips for travel insurance.

- There’s even an online forum where you can talk to other customers.

- You can also use RATES.ca to compare car, home, life, and commercial insurance rates, credit cards, and mortgage rates. They even offer pet insurance.

- Overall, rates.ca lets you compare travel insurance quotes for Canadians or visitors to Canada. The site does have a few minor bugs and inconveniences.